The impact of European universities on patenting and innovation in Europe

We highlight the key findings from the EPO’s recent report on academic patenting by European universities.

The Patent Box and Research and Development (R&D) Tax Relief schemes reward businesses who invest in the development of new innovations. If your business is undertaking R&D, you should consider whether you can take advantage of these UK government schemes.

The Patent Box is a tax relief scheme which was first introduced on 1 April 2013. Under the scheme, companies pay a reduced rate of 10% corporation tax on income derived from qualifying patented inventions and other forms of qualifying intellectual property (IP) rights. The aim of the scheme is to provide an additional incentive for companies to retain and commercialise existing patents and to develop new, innovative patented products.

Any company which is liable to pay corporation tax in the UK, makes a profit from exploiting patented inventions, and owns or licences qualifying IP rights can benefit from the Patent Box.

To qualify for the Patent Box, companies must own or hold an exclusive licence for a patent granted by the UK Intellectual Property Office, the European Patent Office or another approved office.

(The approved offices also include the patent offices of Austria, Bulgaria, Czech Republic, Denmark, Estonia, Finland, Germany, Hungary, Poland, Portugal, Romania, Slovakia and Sweden.)

In addition, companies must have created the patented invention or significantly contributed towards the creation of the patented invention, the development of the patented invention, or the development of an item or process incorporating the invention.

Further qualifying conditions may apply to groups of companies, for example, where one company is developing the IP and another one owns and manages the portfolio.

Other forms of IP, such as supplementary protection certificates, may also be considered as qualifying IP rights.

It is not possible to claim a Patent Box benefit until after a qualifying IP right – typically a patent – has been granted. However, once granted, relief can then be claimed for profits made up to six years prior to grant (so long as the company has elected in for the accounting period in which those profits were made).

A company may elect in to the Patent Box regime for profits earned in a particular accounting period within two years of the end of that period. If a company elects in to the regime all of its trade will be subject to the Patent Box. It is possible for a company to elect out of the Patent Box regime. It will then be barred from re-entering the Patent Box regime for five years.

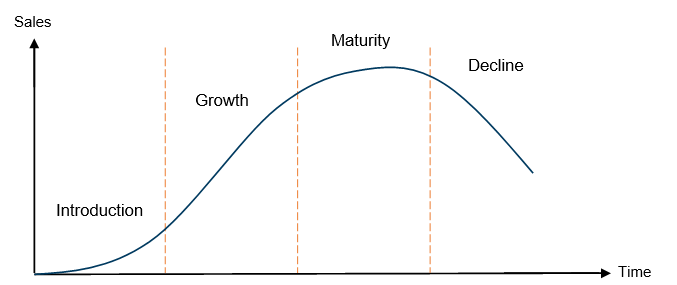

Therefore, the decision as to whether to elect in and when can be important. The following graph shows the different stages of development and commercialisation in a product’s life cycle and the notional value in each, in terms of annual sales.

As this graph shows, sales volume and therefore profit from a patented product is often smaller in the introduction stage, increases in the growth stage and maximises in the maturity stage of development.

Therefore, it would usually be best to elect in to the Patent Box at a point in the life cycle toward the end of the introduction stage in order to maximise the value of the Patent Box.

Companies can benefit from a reduced rate of just 10% corporation tax on income attributed to qualifying IP rights, almost half the normal rate of 19% for the years starting 1 April 2017, 2018 and 2019 and at 18% for the year starting 1 April 2020.

The tax reduction applies to all worldwide profits which are directly attributable to patented products or processes, and can therefore offer significant benefits.

The following types of income would be eligible for the tax relief:

If you think that your business could be eligible to claim for the Patent Box, there are a number of ways we can assist you, including:

R&D tax relief rewards a company’s investment in R&D projects which aim to make an advance in science or technology.

It allows companies to claim tax relief against the costs incurred in developing new products, processes or services.

Companies of any size can claim R&D tax relief, regardless of whether they are profit or loss making. Depending on the size of your company, the benefits are slightly different.

SMEs are defined as a company with fewer than 500 people, turnover of under €100m or a balance sheet total under €86m. SME R&D relief allows companies to:

The large company regime much has been made more generous by introducing the Research and Development Expenditure Credit (RDEC).

RDEC allows larger companies from 1 April 2013, to recognise the benefit of their R&D claim effectively as a grant against cost, opposed to within the tax line, which helps add visibility. Loss makers are now also able to claim cash back from HMRC.

From 1 January 2018, the credit rate increased to 12% (from 11%), providing a net cash benefit of 9.72% at a 19% tax rate. Unlike the superdeduction scheme applicable to the SME relief, which only has a cash value if the company was paying corporation tax; RDEC is payable regardless of the tax position, subject to some restrictions including a cap based on PAYE and NI.

The definition of R&D in the legislation is quite broad and if your company is creating new products, processes or services or finding ways to improve existing ones, you are likely to meet the criteria.

To qualify for R&D tax relief, you need to be able to explain how a project:

You do not need to have obtained any intellectual property protection as a result of your R&D to qualify for the tax relief.

Your project does not also necessarily have to be successful to qualify as R&D.

For companies undertaking qualifying R&D, the tax relief provided by this scheme can reduce your tax bill or in some cases, give you a cash injection into the business through a payable tax credit.

SMEs can benefit from tax relief up to 26% (if in profit) and 33.35% (if loss making) on qualifying R&D expenditure and large companies can claim tax relief of up to 12%.

The relief can be claimed on a range of research costs, including:

Whilst intellectual property protection is not a requirement for qualifying for R&D tax relief, it can help to protect your investment in R&D and give you a competitive advantage against your competitors. It also assists with clarifying the answers to the qualifying questions (looked for an advance in science and technology, had to overcome uncertainty, tried to overcome this uncertainty and could not be easily worked out by a professional in the field).

If you think you have a new invention or development which could be protected by a patent, please contact us to arrange a free initial consultation.

For further advice on claiming patent box or R&D tax relief, speak to your accountant or get in touch and we can introduce you to accountants who specialise in this field.